Slowing inflation and a growing economy helped major stock indexes end the six-month period on a positive note, with small cap and value returning as the top performers. The Russell 2000 index closed the month at +7.95%, the S&P 500 index at +6.47%, the Nasdaq 100 at +6.49% (+32% since the beginning of the year, the best start to the year since 1982), the Euro Stoxx 50 at +4.29%. On the macro side, data on inflation and especially on the Shelter index will be the drivers that will provide directionality to the market, which could weaken with a small correction or maintain a sideways movement if there is a rotation to Value stocks whose function right now would be to support the indexes. The focus has now shifted from recession to inflation, and this is a movie that is bound to be seen throughout 2023. On recession we are not worried, we believe we are facing a win-win situation for the following reasons:

– Strong recession = rate cut = growth stocks still up, although volatility will increase;

– Mild recession or no landing= higher-than-expected earnings of growth stocks, given the cuts in manager guidelines made in recent months.

In the US, inflation is in line with rates at 5%, while the situation is very different in the EU with rates at 3.50% and inflation at 6%. Here there is much more work to be done. Central banks now seem more interested in adjusting to market expectations (as they anticipate forward guidance), because it is a game that is played much more on communication than on data (often anticipated and discounted). However, of U.S. inflation, we do not like the fact that the descent was overly influenced by the energy component, while the Shelter (sheltered goods, real estate) component was again higher than expected.

In our opinion, precisely because of the possibility of a mild recession, the energy component may have seen the lows, and if oil were to rise again (very likely), the next U.S. inflation data could be higher than expected. The geopolitical variable could influence the oil trend in the opposite direction: if the Russian internal crisis leads to a worsening of the conflict, this would reinforce the bullish view; conversely, if Putin were to start easing engagement in Ukraine, oil could fall. In conclusion, the data to monitor in the coming months is the Shelter index, this is where the game of monetary policy and thus the chances of continued gains for growth stocks is played out. We have our Plan B in case of inflation, due to energy rises, rises: we would simply reduce positions in growth stocks to go for the profit taking that would be created. However, this scenario has a 35% lower probability than Plan A, which envisions stable or declining inflation. Crucial then will be Corporate America’s quarterlies in July, which may hold some surprises.

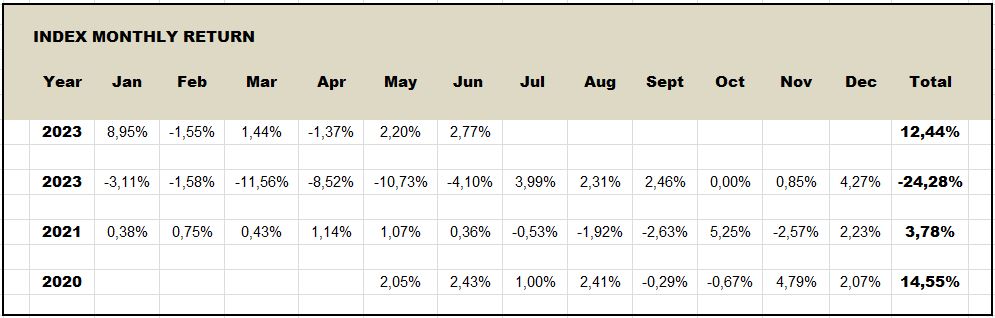

All of our themes have run higher than expected and we are easing out of caution. We are recovering from the loss

of the awful 2022 and on the higher risk profiles we are in sharp gains.

Having sold a lot of stocks lately, we have liquidity in the accounts ready for tactical operations to optimize management, an opportunity, or an event that changes our mind (for example, if July’s quarterlies turn out to be very good.

In operational terms, we continued to be averagely invested in the areas

Megatrends – Robotics – Building Products – Utilities – Banks – Food, Beverage & Tobacco – Hotels Restaurants & Leisure – Pharmaceuticals & Life Sciences, Media & Entertainment – Software & Services.

We decided to accompany the Nasdaq best 10 stocks line with a similar S&P 500 best 10 stocks line eliminated all hedging, and simultaneously opened a long position on Gold greater stability to the NAV in this period of high volatility.

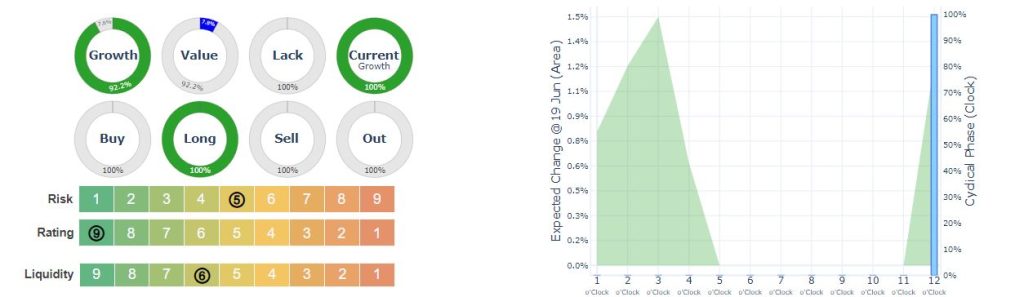

As always using our AI we try to balance sectors and investment timing always with a Long vision but we are conscious that all indicators show a worsening of the situation that could lead to sharp Sell Offs.

Overall, our index remains Growth with a Long view, high liquidity of the securities included in the portfolio, and active risk management.